Master Trading Sessions

Build real expertise in financial markets through hands-on experience. Our program combines practical trading knowledge with technical analysis skills you'll actually use.

Get Program Details

What You'll Learn

Our curriculum covers everything from market fundamentals to advanced trading strategies. Each module builds on the previous one, so you develop skills progressively rather than jumping around randomly.

Market Fundamentals

Understanding how different sessions operate, from Asian markets opening to New York close. You'll learn why timing matters and how global events ripple through trading hours.

Technical Analysis

Chart reading, pattern recognition, and indicator analysis. We focus on tools that actually work in real trading environments, not just theoretical concepts.

Risk Management

Position sizing, stop losses, and portfolio protection strategies. This might be the most important module – it's definitely saved our students from major losses.

Session Strategies

Different approaches for different market sessions. London opening requires different tactics than Tokyo afternoon or New York lunch hours.

Meet Your Instructors

Each instructor brings different market experience and trading perspectives. You'll learn from people who've actually navigated both bull and bear markets successfully.

Kai Nordström

Senior Market Analyst

Started trading during the 2008 crisis and learned risk management the hard way. Now specializes in Asian session strategies and volatility analysis. His approach focuses on patience over quick profits.

Magnus Petrov

Quantitative Strategist

Former hedge fund analyst who moved into education after realizing he preferred teaching complex concepts to managing other people's money. Excellent at breaking down technical indicators into understandable pieces.

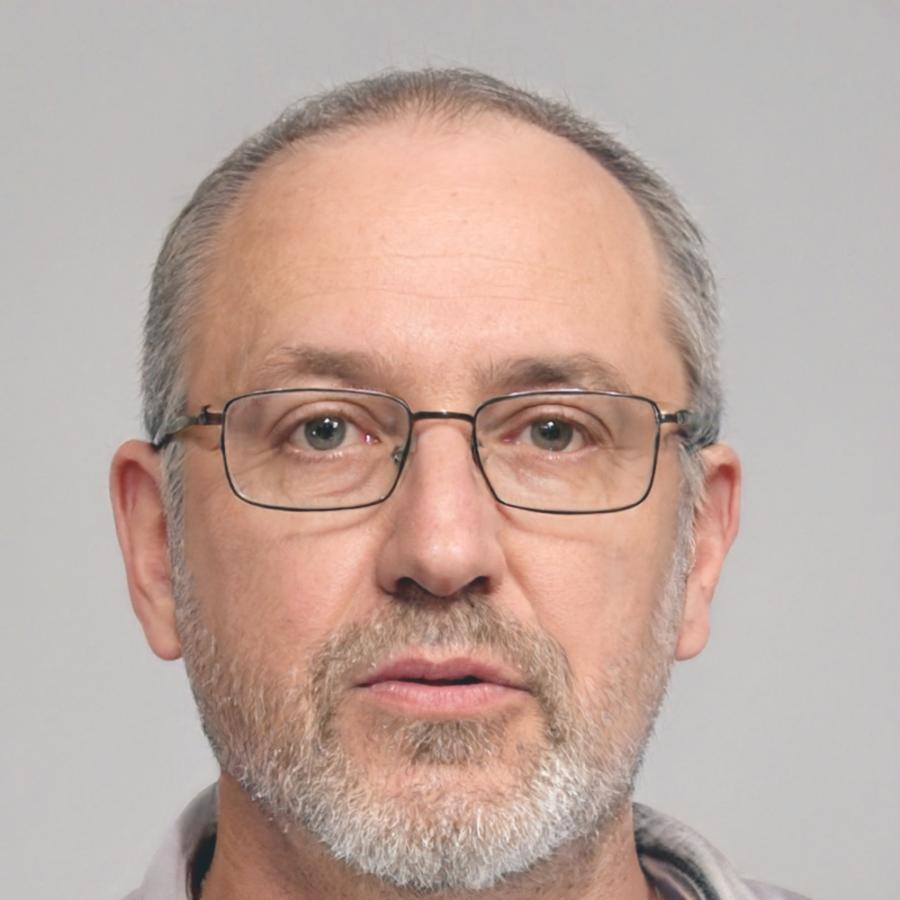

Viktor Andersen

Risk Management Specialist

Spent fifteen years in institutional trading before switching to education. His risk management module has probably prevented more student losses than any other part of our program.

Elena Svensson

Program Director

Coordinates the entire program and teaches the fundamental sessions. She has a talent for connecting different concepts and helping students see how everything fits together in real trading situations.

Program Timeline

Our next cohort starts in September 2025. The program runs for six months with flexible evening and weekend options for working professionals.

Program Launch

Introduction to markets, basic terminology, and your first simulated trades. We'll also cover platform setup and basic chart reading during these first few weeks.

Technical Skills Development

Deep dive into chart analysis, indicators, and pattern recognition. You'll practice identifying setups and learn to distinguish between high and low probability trades.

Session Strategies

Learn how different trading sessions behave and develop strategies specific to each time zone. This is where things get really practical and applicable.

Advanced Application

Live trading with small positions, portfolio management, and final projects. You'll present your own trading plan and get feedback from instructors and peers.

Ready to Start Learning?

Applications for September 2025 open in June. We keep class sizes small to ensure everyone gets individual attention and feedback on their progress.